2023 Market Forecast

As more and more media headlines suggest doom and gloom for the housing market and our economy, this question is probably top-of-mind for many people right now.

While I can’t fully forecast the future, I can do my best to provide an opinion based on data, insights, and my own experiences working in the current market.

The most important piece to note is that this is a dynamic market that is very fluid. When we see big shifts in housing like we did 6 months ago after coming off a record-breaking year, it’s easy to panic and assume that the housing market is crashing.

Yes, some homes are staying on the market longer, but some are still selling quickly. We’re not seeing a large influx of new listings, suggesting we’re returning back to the seasonal norms we typically see this time of year. But it is still a seller’s market. Why? Because prices are driven by supply and demand, and we still have a low supply of homes on the market. This means continued upward pressure on home prices. Here in DuPage County, Illinois, a western suburb of Chicago, the supply is only 1.4 months as of January 10th. Nationally, that number is 3 months, which is still extremely low.

And for the naysayers who are calling for a housing crisis, this quote from Redfin sums it up best:

“For those bearish folks eagerly awaiting the home price crash, you’ll have to keep waiting. As much as demand is pulling back, supply is as well. And that’s reducing downward pressure on prices in the short run.”

Looking at the latest update on the home price forecasts for next year we see this: some experts are projecting slight appreciation, and others are calling for slight depreciation.

When we average these together, we see relatively neutral or flat home price appreciation for 2023.

More than anything else, this year’s housing market has been defined by rapidly rising mortgage rates. And they haven’t just risen. They have more than doubled in less than a year, something that has never been seen before.

To put that into context, the average monthly mortgage payment is about $1000 more than it was a year ago.

But the biggest question that you need you to be able to answer is why, and the answer to that is inflation. The FED has been making moves to slow the economy down and real estate plays a big part in our economy.

So, as inflation stays high, mortgage rates will stay high. And as history tells us, when inflation starts to ease, mortgage rates should too. As people ask about what will happen going forward, the answer is to just keep an eye on what’s happening with inflation.

Then there’s the other piece of this, the dreaded “r” word: recession.

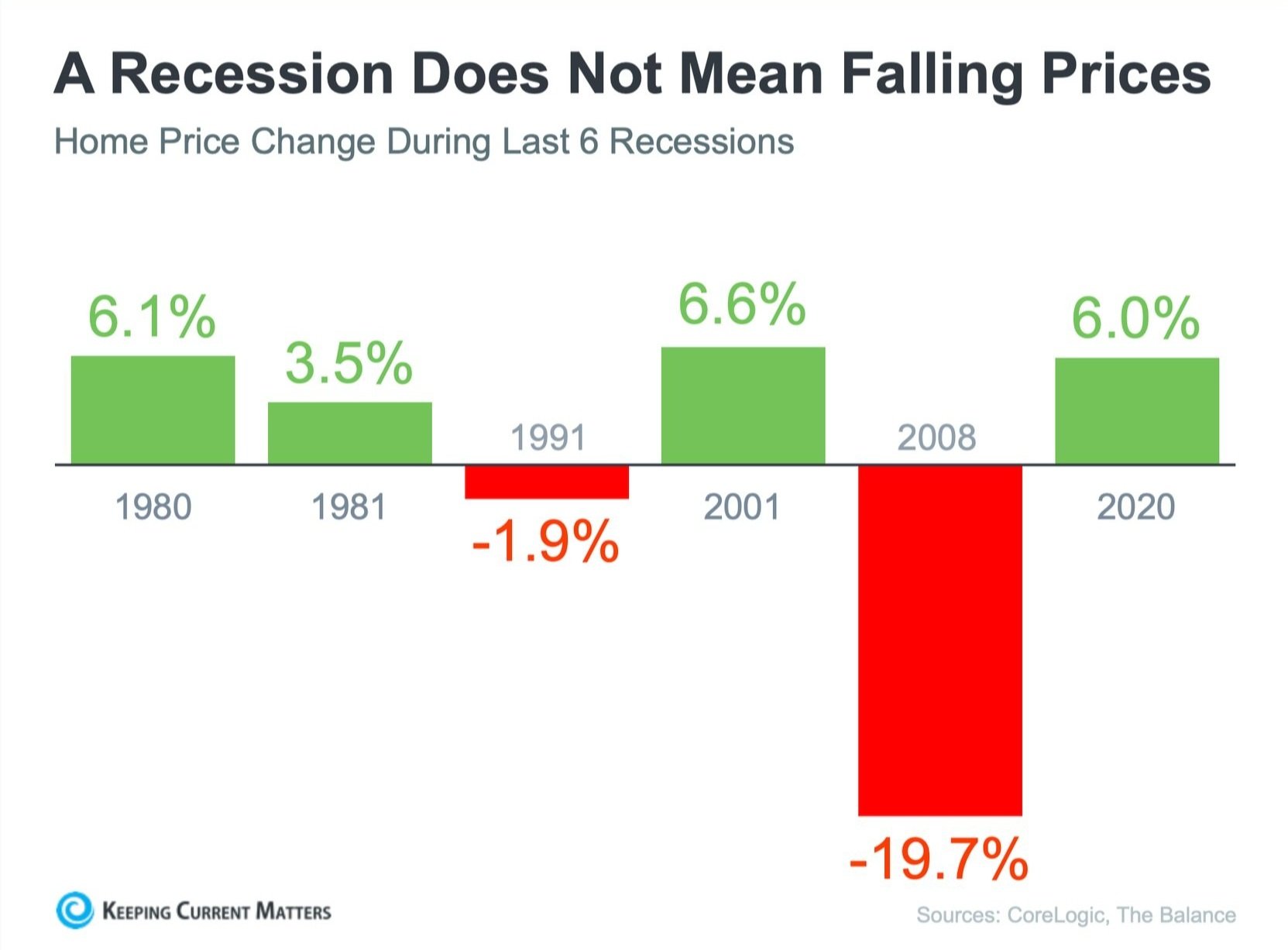

The biggest question here is if a recession is called, how will it impact the housing market? For most buyers and sellers, they think that a recession means a full-on housing market collapse like what happened in 2008. And in most instances, the truth couldn’t be further from that.

For example, a recession does not mean falling home prices. In the past 6 recessions, only 2 of them saw a decrease in home prices.

But bringing it back to mortgage rates, a recession may not always cause home prices to fall, but it usually means mortgage rates will.

Ultimately, both of the previous questions lead to this one.

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt. These decisions can be hugely consequential for consumers and businesses,” said Jason Lewis, co-founder & chief data officer of Parcl.

So, is it a good time to buy a home right now? The answer may be different for every person.

For first-time homebuyers, the biggest factor to consider is rising rent costs around the country. Homeownership presents the opportunity for a stable monthly payment as well as the ability to build wealth and make a financial investment. It offers security and a sense of accomplishment that renting can’t.

The next piece of this is that life happens. Personal situations change, jobs require relocation, aging parents may need to move in, etc. These can all play a big part in someone’s need to buy or sell a home right now or in the near future.

Experts predict what the housing market will look like in this Forbes article which is also an interesting read.

At the end of the day, while the market may be changing, there are many financial and non -financial benefits of homeownership that stand the test of time. It’s one of the biggest ways to build wealth in this country.

Feel free to reach out with any question!

I’m always striving to be the best real estate agent in Wheaton, looking for specific content? Get in touch!